Mgm online kasiino

All games of chance generally have a negative expectation. As a player, you must always expect to lose in the long run. There are no tricks or strategies in online casinos that can change this paypal eesti. To better understand your personal odds, you need to understand how gambling works. Explaining this is beyond the scope of this FAQ. This is covered in detail on our how to play page (located on the main menu of this site). Anyone who has read and understood this guide can call themselves a professional player and know how to correctly assess their chances of winning.

Wer Spiele mit besonders großem Potenzial sucht, sollte Spielautomaten von Big Time Gaming wie Bonanza oder von Thunderkick zum Beispiel The Falcon Huntress testen. Millionen Gewinne sind in Online Casinos durch progressive Jackpots möglich. Die Hauptgewinne steigen stetig bis zur Auszahlung an. Am bekanntesten ist in diesem Bereich wohl Mega Moolah von Microgaming. Dieser Slot ermöglichte einem Spieler den bisher größten Gewinn von fast 19 Millionen Euro.

Here you will find an up-to-date list of the best online casinos. You can sort the list by GambleJoe ranking or user ranking. Compared to our competitors, security is our top priority. That’s why GambleJoe only offers casinos with European gaming licences.

Am Ende muss man sich für ein seriöses Online Casino entscheiden. Dabei kommt es vor allem auf den ersten Eindruck an. Wenn man sich das Casino ansieht, das Design gut findet und vielleicht im Footer eine Lizenz der Malta Gaming Authority (MGA) oder einer anderen guten Konzession sieht, sind das positive Zeichen.

Immer mehr intelligente Spieler wandern aus den Spielotheken ab und spielen nur noch in Online Casinos. Nun ist es allerdings so, dass Online Casinos aufgrund fehlender Lizenzierungsmöglichkeiten und enormer Steuervorteile ihren Sitz nicht in Deutschland, sondern im Ausland haben und es hier eine Kleinigkeit zu beachten gibt. So unterliegen Bareinzahlungen, aber auch Auslandszahlungen ab einer bestimmten Summe bestimmter Meldepflichten. Bei Auslandsüberweisungen nennt sich das Ganze Meldevorschriften im Außenwirtschaftsverkehr – was aber nur Auslandstransaktionen ab einer Höhe von 12.500 € pro Transaktion betrifft.

Pesa

3W6-der-Reihe-nach bei B/X finde ich, in Verbindung mit frühen und hohen Boni und vor allem verkrüppelnden Mali persönlich auch nicht schön, aber genau wie niedrige TP und Tod bei Null kann man das leicht ändern–und weil Hausregeln bei (älteren Fassungen von) D&D allgemein üblich und leicht in das modulare System einzubauen sind, sehe ich das auch als legitim und nicht als unlogische Verteidigung nach dem Motto „Kein Problem, denn du kannst es ja ändern.“

I’m not fond of 3d6-down-the-line in B/X either, due to the combination of early and high bonuses and especially crippling penalties, but just like low hp and death at zero you can easily change that – and since house rules are common in (older versions of) D&D and easy to build into the modular system, I also see that as legitimate and not an illogical defense along the lines of „No problem, because you can change it.“

3W6-der-Reihe-nach bei B/X finde ich, in Verbindung mit frühen und hohen Boni und vor allem verkrüppelnden Mali persönlich auch nicht schön, aber genau wie niedrige TP und Tod bei Null kann man das leicht ändern–und weil Hausregeln bei (älteren Fassungen von) D&D allgemein üblich und leicht in das modulare System einzubauen sind, sehe ich das auch als legitim und nicht als unlogische Verteidigung nach dem Motto „Kein Problem, denn du kannst es ja ändern.“

I’m not fond of 3d6-down-the-line in B/X either, due to the combination of early and high bonuses and especially crippling penalties, but just like low hp and death at zero you can easily change that – and since house rules are common in (older versions of) D&D and easy to build into the modular system, I also see that as legitimate and not an illogical defense along the lines of „No problem, because you can change it.“

Ah yes, I forgot he published it on his own! I recently started running a group through another Artpunk-Contest entry (Vault of the Warlord), a playtest report is forthcoming there, and for Hell’s Own Temple once played, it will be done. I cannot restate how much I think the high level play is were 1e shines the most and how only actual play can give you experience in that. We will hopefully soon-ish finish the big Huso-Module (Nether Prince), I have lots of thoughts on that one.

It’s really nonsense that Mentzer’s *Immortal Rules* require you to give up everything to become a god and start over at level 1. That’s just empty posing and has nothing to do with playable or even tested rules.

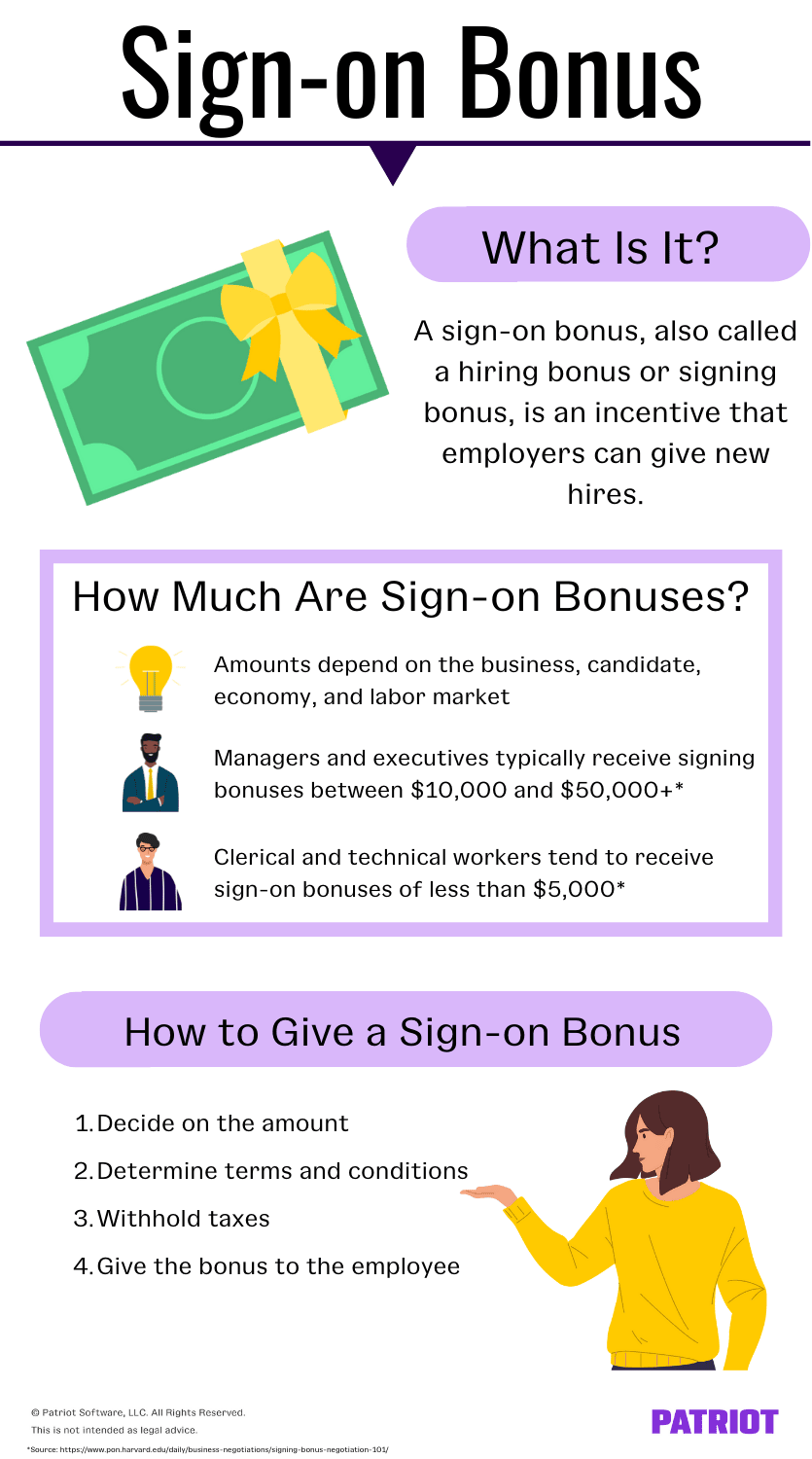

Bonus

If you are employed and receive a travel allowance from your employer, you are able reduce your taxable income by claiming a tax deduction for the fuel you bought and maintenance costs. This quick “Travel tax deduction calculator” calculator shows you how much you can claim.

Just how much tax could you save in taxes by maximizing your retirement annuity contributions? SARS allows you to invest up to 27.5% of your income (capped at R350,000 per year) and deduct it from your taxable income. This table shows the maximum tax savings you can achieve for different income levels .

You earn R40 000 per month. You decide to invest R5 000 into a retirement annuity. SARS will not tax you on the R40 000. Instead, you only pay tax on R35 000. The contribution you made to the retirement annuity reduces your taxable income. And you pay less tax.

If you are employed and receive a travel allowance from your employer, you are able reduce your taxable income by claiming a tax deduction for the fuel you bought and maintenance costs. This quick “Travel tax deduction calculator” calculator shows you how much you can claim.

Just how much tax could you save in taxes by maximizing your retirement annuity contributions? SARS allows you to invest up to 27.5% of your income (capped at R350,000 per year) and deduct it from your taxable income. This table shows the maximum tax savings you can achieve for different income levels .

You earn R40 000 per month. You decide to invest R5 000 into a retirement annuity. SARS will not tax you on the R40 000. Instead, you only pay tax on R35 000. The contribution you made to the retirement annuity reduces your taxable income. And you pay less tax.